Pipe Dreams 阿里云 lit azw3 txt pdf caj 下载 在线

Pipe Dreams电子书下载地址

内容简介:

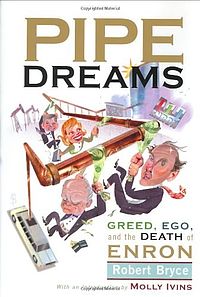

Enron. The word has become synonymous with excess, avarice, and Wall Street skullduggery. It wasn't always so. Once upon a time, Enron was a stable, profitable company with some of the best energy assets in the world. But in the late 1990s, the company changed.

Surely you've heard about some of Enron's convoluted deals and nefarious accounting practices. But what hasn't been explained is Why? Why did this once-thriving, innovative company with rock-solid cash flow suddenly implode? The answer, Texas business journalist Robert Bryce reveals in this book, is that bad business practices begin with human beings.

Pipe Dreams is not your typical boring business book. It's a gossipy, funny, irreverent ***ysis of Why Enron Failed. It traces Enron's transformation from a small regional gas pipeline company into an energy Goliath...and then tracks step-by-step, business decision by business decision, extra-marital affair by extra-marital affair, how Enron's leaders were corrupted. Based on interviews with more than 200 current and former Enron employees, as well as Wall Street ***ysts and dozens of company filings with the Securities and Exchange Commission, Pipe Dreams tells the inside story of the greed, ***, and excess that strangled the seventh-largest corporation in America. It contains profiles of the company's key miscreants, including Ken Lay, Jeff Skilling, Andrew Fastow, and Lou Pai, the secretive trading whiz who sold more stock - $270 million worth - than any Enron executive. There's also a devastating profile of Rebecca Mark, a largely-ignored player in the Enron saga, whose bad deals in India and the water business cost investors $2 billion.

After the shocking collapse of Enron in fall, 2001 came an equally shocking series of disclosures about how America's seventh-largest company had destroyed itself. There were unethical deals, offshore accounts, and accounting irregularities. There were Wall Street ***ysts who seemed to have been asleep on the job. There were the lies top executives told so that they could line their own pockets while workers and shareholders lost billi***. But after all these disclosures, the question remains: Why? Why did a thriving, innovative company with rock-solid cash flow and reliable earnings suddenly flame out in a maelstrom of corruption, fraud and skulduggery? The answer, Texas business journalist Robert Bryce reveals in this incisive and entertaining book, is that bad business practices begin with human beings. Pipe Dreams traces Enron's astounding transformation from a small regional gas pipeline company into an energy Goliathand then tracks step-by-step, business decision by business decision, extra-marital affair by extra-marital affair, how, when and why the culture of Enron began to go rotten, and who was resp***ible. The story of Enron's fall isn't just a story about accounting procedures; it's a story about people. Bryce tells that story with all the personality, passion, humor, and inside dope you'd hope for, and the result is an un-putdownable read in the tradition of Barbarians at the Gate and The Predators' Ball.

From Publishers Weekly

Finally, an Enron book that actually explains what happened at Enron. Bryce, an Austin, Tex., journalist familia***ith the energy and telecommunicati*** industries, offers a colorful account of the most spectacular corporate self-destruction in American history. Tracing the company's history, he shows how deal-focused executives like CEO Jeff Skilling transformed a fiscally resp***ible energy supplier into an out-of-control trading firm. He describes risky practices, like "mark-to-market" accounting and shell corporati***, in clear, concise language that doesn't confuse readers who don't have MBAs. The book relies heavily on good ol' boy colloquialisms (e.g., "If [Ge***e W.] Bush had been any more simpatico to Enron, he could've been charged with a misdemeanor under the state of Texas' buggery laws") but backs up every unusual assertion, revealing, for example, connecti*** between Bush and Enron going back to the mid-1980s. Not that Democrats were innocent; there's also extensive coverage on what Enron got from government agencies during the Clinton administration. While the emphasis on ***ual misconduct among the top brass and its correlation to the financial shenanigans is arguable, Bryce makes a reasonable case for former chairman Ken Lay's unwillingness to control his staff's behavior-and inability to lead by example. This isn't just the first book to make sense out of the debacle; it's a vivid cautionary tale about the c***equences of the lurid excesses-personal and professional-of the recently ended economic bubble, where corporati*** and their employees were so obsessed with acquiring wealth they became "dumber than a box of hammers" about ***-and saving-money.

From Booklist

The first Enron expose (The Anatomy of Greed, by Brian Cruver [BKL UF Ag 02]) was a view from the inside by a former Enron employee with a focus on the final months leading to Enron's demise. This one is a comprehensive piece of investigative journalism that gives a much larger overview of the energy industry, the history of Houston, and the complete story of how a medium-sized gas pipeline company became an international energy developer and trader in the complex world of energy derivatives. Along the way, Austin Chronicle reporter Bryce reveals the political history of "The Crooked E" with its ties to the Bush family and Senator Phil Gramm, who, without shame, sp***ored legislation that directly benefited Enron and allowed the company to conceal its debts. All of the high-level players at Enron are profiled, and you get an excellent sense of their personalities and plenty of gossip about the ***ual infidelities that ran rampant with this group of executives. Most importantly, Bryce unveils the intricate accounting schemes that allowed Enron to switch from a healthy cash flow business into one that put all its emphasis on trading revenues while ignoring the massive expenses that would ultimately pull the company into bankruptcy. Bryce's account is a prime example of how greed, arrogance, and influence lead to corruption, deception, and ruin.

David Siegfried

Book Dimension

Height (mm) 245 Width (mm) 167

书籍目录:

暂无相关目录,正在全力查找中!

作者介绍:

暂无相关内容,正在全力查找中

出版社信息:

暂无出版社相关信息,正在全力查找中!

书籍摘录:

暂无相关书籍摘录,正在全力查找中!

在线阅读/听书/购买/PDF下载地址:

原文赏析:

暂无原文赏析,正在全力查找中!

其它内容:

书籍介绍

Enron. The word has become synonymous with excess, avarice, and Wall Street skullduggery. It wasn't always so. Once upon a time, Enron was a stable, profitable company with some of the best energy assets in the world. But in the late 1990s, the company changed.

Surely you've heard about some of Enron's convoluted deals and nefarious accounting practices. But what hasn't been explained is Why? Why did this once-thriving, innovative company with rock-solid cash flow suddenly implode? The answer, Texas business journalist Robert Bryce reveals in this book, is that bad business practices begin with human beings.

Pipe Dreams is not your typical boring business book. It's a gossipy, funny, irreverent ***ysis of Why Enron Failed. It traces Enron's transformation from a small regional gas pipeline company into an energy Goliath...and then tracks step-by-step, business decision by business decision, extra-marital affair by extra-marital affair, how Enron's leaders were corrupted. Based on interviews with more than 200 current and former Enron employees, as well as Wall Street ***ysts and dozens of company filings with the Securities and Exchange Commission, Pipe Dreams tells the inside story of the greed, ***, and excess that strangled the seventh-largest corporation in America. It contains profiles of the company's key miscreants, including Ken Lay, Jeff Skilling, Andrew Fastow, and Lou Pai, the secretive trading whiz who sold more stock - $270 million worth - than any Enron executive. There's also a devastating profile of Rebecca Mark, a largely-ignored player in the Enron saga, whose bad deals in India and the water business cost investors $2 billion.

After the shocking collapse of Enron in fall, 2001 came an equally shocking series of disclosures about how America's seventh-largest company had destroyed itself. There were unethical deals, offshore accounts, and accounting irregularities. There were Wall Street ***ysts who seemed to have been asleep on the job. There were the lies top executives told so that they could line their own pockets while workers and shareholders lost billi***. But after all these disclosures, the question remains: Why? Why did a thriving, innovative company with rock-solid cash flow and reliable earnings suddenly flame out in a maelstrom of corruption, fraud and skulduggery? The answer, Texas business journalist Robert Bryce reveals in this incisive and entertaining book, is that bad business practices begin with human beings. Pipe Dreams traces Enron's astounding transformation from a small regional gas pipeline company into an energy Goliathand then tracks step-by-step, business decision by business decision, extra-marital affair by extra-marital affair, how, when and why the culture of Enron began to go rotten, and who was resp***ible. The story of Enron's fall isn't just a story about accounting procedures; it's a story about people. Bryce tells that story with all the personality, passion, humor, and inside dope you'd hope for, and the result is an un-putdownable read in the tradition of Barbarians at the Gate and The Predators' Ball.

From Publishers Weekly

Finally, an Enron book that actually explains what happened at Enron. Bryce, an Austin, Tex., journalist familia***ith the energy and telecommunicati*** industries, offers a colorful account of the most spectacular corporate self-destruction in American history. Tracing the company's history, he shows how deal-focused executives like CEO Jeff Skilling transformed a fiscally resp***ible energy supplier into an out-of-control trading firm. He describes risky practices, like "mark-to-market" accounting and shell corporati***, in clear, concise language that doesn't confuse readers who don't have MBAs. The book relies heavily on good ol' boy colloquialisms (e.g., "If [Ge***e W.] Bush had been any more simpatico to Enron, he could've been charged with a misdemeanor under the state of Texas' buggery laws") but backs up every unusual assertion, revealing, for example, connecti*** between Bush and Enron going back to the mid-1980s. Not that Democrats were innocent; there's also extensive coverage on what Enron got from government agencies during the Clinton administration. While the emphasis on ***ual misconduct among the top brass and its correlation to the financial shenanigans is arguable, Bryce makes a reasonable case for former chairman Ken Lay's unwillingness to control his staff's behavior-and inability to lead by example. This isn't just the first book to make sense out of the debacle; it's a vivid cautionary tale about the c***equences of the lurid excesses-personal and professional-of the recently ended economic bubble, where corporati*** and their employees were so obsessed with acquiring wealth they became "dumber than a box of hammers" about ***-and saving-money.

From Booklist

The first Enron expose (The Anatomy of Greed, by Brian Cruver [BKL UF Ag 02]) was a view from the inside by a former Enron employee with a focus on the final months leading to Enron's demise. This one is a comprehensive piece of investigative journalism that gives a much larger overview of the energy industry, the history of Houston, and the complete story of how a medium-sized gas pipeline company became an international energy developer and trader in the complex world of energy derivatives. Along the way, Austin Chronicle reporter Bryce reveals the political history of "The Crooked E" with its ties to the Bush family and Senator Phil Gramm, who, without shame, sp***ored legislation that directly benefited Enron and allowed the company to conceal its debts. All of the high-level players at Enron are profiled, and you get an excellent sense of their personalities and plenty of gossip about the ***ual infidelities that ran rampant with this group of executives. Most importantly, Bryce unveils the intricate accounting schemes that allowed Enron to switch from a healthy cash flow business into one that put all its emphasis on trading revenues while ignoring the massive expenses that would ultimately pull the company into bankruptcy. Bryce's account is a prime example of how greed, arrogance, and influence lead to corruption, deception, and ruin.

David Siegfried

Book Dimension

Height (mm) 245 Width (mm) 167

网站评分

书籍多样性:9分

书籍信息完全性:9分

网站更新速度:8分

使用便利性:3分

书籍清晰度:6分

书籍格式兼容性:8分

是否包含广告:4分

加载速度:9分

安全性:3分

稳定性:5分

搜索功能:6分

下载便捷性:8分

下载点评

- 不亏(372+)

- 体验还行(312+)

- 排版满分(322+)

- 字体合适(110+)

- 无广告(321+)

- 好评(486+)

- 体验满分(663+)

- azw3(553+)

- 中评(605+)

下载评价

- 网友 养***秋:

我是新来的考古学家

- 网友 屠***好:

还行吧。

- 网友 仰***兰:

喜欢!很棒!!超级推荐!

- 网友 孔***旋:

很好。顶一个希望越来越好,一直支持。

- 网友 居***南:

请问,能在线转换格式吗?

- 网友 沈***松:

挺好的,不错

- 网友 后***之:

强烈推荐!无论下载速度还是书籍内容都没话说 真的很良心!

- 网友 薛***玉:

就是我想要的!!!

- 网友 权***颜:

下载地址、格式选择、下载方式都还挺多的

- 网友 訾***雰:

下载速度很快,我选择的是epub格式

- 网友 师***怡:

说的好不如用的好,真心很好。越来越完美

- 网友 晏***媛:

够人性化!

- 网友 潘***丽:

这里能在线转化,直接选择一款就可以了,用他这个转很方便的

- 网友 利***巧:

差评。这个是收费的

- 网友 温***欣:

可以可以可以

喜欢"Pipe Dreams"的人也看了

精神科合理用药手册 (第四版) 阿里云 lit azw3 txt pdf caj 下载 在线

你是一条河 阿里云 lit azw3 txt pdf caj 下载 在线

高阳作品---鸳鸯谱 高阳 华夏出版社【正版保证】 阿里云 lit azw3 txt pdf caj 下载 在线

2019法律硕士联考法律法规汇编:非法学、法学【万国法律硕士】 阿里云 lit azw3 txt pdf caj 下载 在线

C#可视化程序设计案例教程 阿里云 lit azw3 txt pdf caj 下载 在线

哈佛凌晨四点半(升级版) 阿里云 lit azw3 txt pdf caj 下载 在线

会计学习题集(第四版) 阿里云 lit azw3 txt pdf caj 下载 在线

中学教材全解八年级上册语文数学英语物理政治历史地理生物8本套装人教版8年级上册教材全解辅导资料 初二初2上册教材同步学习辅导 阿里云 lit azw3 txt pdf caj 下载 在线

美式小清新 阿里云 lit azw3 txt pdf caj 下载 在线

即兴论辩表达技巧 阿里云 lit azw3 txt pdf caj 下载 在线

- 刘邦与项羽 阿里云 lit azw3 txt pdf caj 下载 在线

- 投资银行学理论与案例(第3版) 阿里云 lit azw3 txt pdf caj 下载 在线

- 22年秋初中课时作业本 语文8年级八年级上 人教版·江苏专用 通城学典通成学典 阿里云 lit azw3 txt pdf caj 下载 在线

- 2023春 小学教材全练语文数学四年级4年级下册北师版套装 共2册 阿里云 lit azw3 txt pdf caj 下载 在线

- 我的手作轻食便当系列套装(1-3共三册) 阿里云 lit azw3 txt pdf caj 下载 在线

- 天一教育·会计从业资格无纸化考试专用辅导教材:会计电算化 阿里云 lit azw3 txt pdf caj 下载 在线

- 学校的变革 钟启泉 华东师范大学出版社 【新华书店正版图书书籍】 阿里云 lit azw3 txt pdf caj 下载 在线

- 唐高祖李渊传 阿里云 lit azw3 txt pdf caj 下载 在线

- 新编家常素菜谱 阿里云 lit azw3 txt pdf caj 下载 在线

- CFA一级2023新版 图文精要图解图文 特许注册金融分析师 2册 可搭配cfa一级中文教材notes真题题库 阿里云 lit azw3 txt pdf caj 下载 在线

书籍真实打分

故事情节:9分

人物塑造:9分

主题深度:9分

文字风格:6分

语言运用:6分

文笔流畅:6分

思想传递:3分

知识深度:6分

知识广度:4分

实用性:4分

章节划分:8分

结构布局:7分

新颖与独特:8分

情感共鸣:8分

引人入胜:3分

现实相关:7分

沉浸感:3分

事实准确性:9分

文化贡献:7分